100 Tips to Save Money Every Day

Being able to save money month after month is a habit that you must forge if you want to have a successful finances. In fact, saving is the first step to financial freedom.

There are many ways to start saving without necessarily sacrificing yourself. It's more about adapting to a more conscious consumerism, keeping our financial priorities clear.

The way we spend is a reflection of our values and what we consider important in our lives. If you are clear that you buy your money for real, making cuts to save should not be a problem. Cut back on what you feel does not make you happy or is of no use in your life.

There are many ways to start saving depending on your life priority, which is why I have divided these saving tips into categories to make it easier for you to decide where you want to start saving.

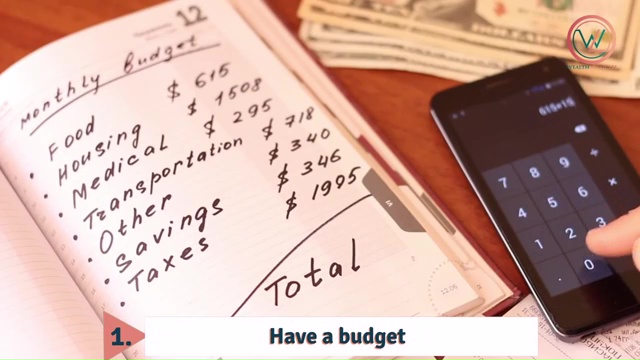

Budget to save:

1. Always have a budget for each month. A budget is the way to tell your money where it should go before you start spending it.

2. Let savings be the first thing that is debited from your salary. Automate this payment each month with your savings account.

3. Set a clear , short-term goal. Go month to month. Here I show you how to establish your savings plan.

4. Start by saving a small amount. They can be $ 10 or $ 20. The important thing is to create the habit . A good system is the 52-week challenge, where you start saving a small amount of money and gradually increase the amount.

5. Create a savings system that works for you. You have your own particular way of doing things, different from others. Try the savings method that suits your personality first and see if it works over the course of a month.

6. Don't save to save, save because you plan to do something with your money. When you have your plan, call it "saving for ...": studying, traveling, paying debts, etc.

7. Always have a shopping list with you to avoid buying what you don't need. Sometimes your memory plays bad pasts on you so always write what you are going to buy. Organize that list in order of importance, first what you need most and then what you can expect. This will allow you to be more aware of your priorities when it comes to spending, postpone purchases that are not urgent and distribute your money in a more equitable way. Important tip: buy only what is on your list.

8. Pay in cash . If you have a credit card, don't go out with it. Cards in general create the illusion of not losing money. When you pay in cash you really see how the money goes out of your hands so it is easier to control expenses.

9. Limit the temptation to spend out of your budget with an allowance. Allocate a percentage of your salary to spend on what you like, either weekly or monthly, in this way you enjoy but without harming your finances.

Create a challenge to spend less:

10. Create a month without expenses, I mean a month where you only spend what is necessary.

11. If you find it too difficult, try weekends or entire weeks at no cost.

12. Choose a certain product that you are not going to buy for a certain time. If you are a compulsive person to buy something, then start this challenge. The money you spent on it you can save.

13. Postpone your shopping. If you're really tempted to buy something, save it for another day or apply the 48-hour rule. You will discover that after this time you have forgotten or you have lost the desire. With this you learn to control your emotions and do not allow them to control your decisions. It's like when you have a fight with your partner and in order not to offend her, you prefer to speak when the mood has calmed down.

14. Stay away from your spending triggers. Cancel your subscription from all the places or web pages that encourage you to buy. Delete your username and password and the history of the page.

15. Reduce your time on social networks as they encourage you to copy other people's lifestyle and ambition more than you need. If you did my challenge for a month without expenses, you would realize how little you need to be happy.

16. Reduce your cell phone plan.

Make more money:

17. Try to earn more money. The best way to grow your savings is by generating more income. You can start by selling items you don't use, working overtime, renting a room in your house or giving private lessons. There are many options, choose the one you like the most.

18. Stop accumulating items and sell what you no longer use. Having more stuff doesn't make you richer. Sell the clothes, appliances and belongings that you do not use.

19. Negotiate the prices of what you buy. In our Latino culture it is a normal habit. Don't feel sorry and offer a lower price, any discount is a sweetheart for your wallet.

20. Check your bank accounts and see what extra expenses your bank is making. If you see that your type of account charges you too much, find out how another type of account you can have or how you can reduce these charges. For example, when reviewing what they charged me in a year I almost fainted. When I went to the bank, they offered me a type of account that does not charge for debit card maintenance but for ATM withdrawals. Since then I make only one withdrawal per month and I have been freed from monthly maintenance costs.

21. Rent a room in your house, the garage or your car.

22. Share your car with other people and charge the "fare".

Save money on purchases:

23. Avoid shopping in season. Shop before or after special dates to take advantage of discounts, bad last-minute decisions, crowds and overall stress.

24. If you are going to buy something you need, look for promotions or discount dates. You can also use coupons.

25. Don't buy when you're under stress, worried, or upset just because you feel better.

26. Always compare prices and don't buy in the first place you see.

27. Cash purchase. Do not pay in installments or using the credit card. In addition, you can receive a discount for paying in cash.

28. If you prefer to pay with your credit card for the points or miles you accumulate, make purchases at a single installment so as not to lose money on interest.

29. Buy in online stores. Some are cheaper. They save you time, stress, being tempted to buy what you don't need.

Save money on food:

30. Based on your weekly menu, have a shopping list. Never go out without your list: you will end up buying what you don't need and going to the supermarket many times.

31. Don't go to the supermarket for just an item or two because you end up buying on impulse or on a whim what you don't need.

32. Eat more natural and less processed foods.

33. Avoid fast foods and constantly eat at restaurants.

34. Budget what you eat at home and outside.

35. Find the cheapest supermarket in your area. Personally, I prefer market places because their products are cheaper (since there are fewer intermediaries and the rents paid by locals there are lower).

36. Eat less meat and more plant protein. Legumes (beans, lentils, chickpeas, peas, etc.) are a great protein if you combine it with a cereal (rice, oatmeal, quinoa, etc.)

37. Immediately freeze your leftovers for any other day (that you don't want to cook).

38. If you have a large family, try to buy in large quantities or where they sell wholesale.

39. If you must eat at work, pack your food either lunch or snacks.

see also more tips to save on Groceries

Save Money on hobbies:

40. Download free books on the internet.

41. Visit the nearest library and read their books.

42. Go to the movies on discount days.

43. If you like liquor, look for Happy Hour at your favorite bars.

44. TAttend free cultural events in your city such as art exhibitions, concerts, or tours.

45. Go on an ecological walk or bike through the green areas of your city.

46. Drop cable TV. Head over to Netflix (zero commercials) or dedicate yourself to reading more.

47. Turn your hobby into a business: sell your crafts; advises others on how to dress well; play your guitar in local bars etc.

48. Go on vacation or visit tourist sites in low season.

49. Make a potluck with your friends. Each person must bring a plate for all the guests.

Save Money on Beauty:

50. Buy generic brands. Some offer the same benefits as expensive maraca products.

51. Use more natural products. The kitchen is a great source of beauty products since your skin is a second mouth.

52. Buy a large jar of virgin coconut oil. It serves as a hair treatment, cream for the body, hands and face, epilator cream, makeup remover, intimate lubricant, cream for breakouts as well as being used in the kitchen.

53. Make a spa at home with natural products.

54. Do your manicure and pedicure at home.

Save Money with People:

55. Stay away from people who motivate you to spend just to satisfy the pleasure of the moment. Instead, surround yourself with people who share your interests and who understand your priorities.

56. Discuss your savings goals with the most important and closest people to you.

57. Talk to your partner and children about the importance of saving and set goals together.

58. If you have children and you go out with them, explain to them before leaving home that they are not going shopping and what is the purpose of the outing.

When you prepare your son for what is coming, he will be more clear about how he should behave (I told you, I was a primary school teacher). Remember not to give in to his tantrum and constantly talk to him about the difference between luxuries and necessities.

59. Spend more time with your children instead of buying more toys or electronics to compensate for your presence.

60. Have free dates with your partner: a glass of wine watching the stars, a walk through the city, a night of massages, etc.

Save money Minimalism:

61. Buy what you need and you are really going to use it. Give what you buy a shelf life instead of just buying.

62. Exchange objects such as books, music, accessories or clothes that you do not use with your acquaintances or friends.

63. Buy good quality products that last a long time.

64. Have a combinable closet . Handle certain basic clothes. This will save you money and time when dressing.

65. Have as few appliances and objects at home as possible. Stick with those that are useful for various purposes.

66. Live in a smaller place, especially if you live alone or with a partner.

67. Keep your house tidy and free of unnecessary objects and you won't need to pay someone else to clean it.

68. Repair the objects or clothes that still work instead of rushing out to buy something new.

69. Think that what you have does not define you . He aspires to be instead of having.

Save Money Habits:

70. Analyze what makes you happy. You will see how your expenses are reduced.

71. Live healthy and exercise frequently. It saves you money on medical treatments and focuses your mind on the positive.

72. Be very clear that it is on your list of needs and wants.

73. Write what you want to do with your money and how you want to get the most out of it. When you have your goal clear, you save on useless expenses that are not in accordance with your life project.

74. Turn off the TV , this reduces the time exposed to commercials and all kinds of shopping triggers.

75. Get together at home with friends, instead of going out frequently.

76. Do not compare yourself with others. Just because someone has more than you does not mean that they are happier or live better. There will always be someone who has less or more than you.

77. Every weekend, schedule your expenses for the next seven days.

78. Check your budget constantly.

79. Check your utility and bank invoices in case of errors or excessive charges for expenses that you have not related.

80. Keep the bills to pay in a visible and orderly place so you don't forget to pay them on time.

81. Use a piggy bank to save change or turns. You will be surprised at how much you can save.

82. Before buying ask yourself: Do I need it or want it? Do I have something similar at home that fulfills the same function?

83. Think positive about money , trust that you can be part of the abundance that exists in the universe.

84. When you get extra money , save it instead of rushing out to spend it.

85. Cut your bad habits like smoking, drinking, buying the lottery or any addiction you have.

Learn about managing your money:

86. Read more about personal finance.

87. Listen, read, and talk to people who are good at handling their money.

88. Visit your bank and ask about the different savings accounts they have and how you can earn some money with them.

89. Automate the payment of your invoices and what else you can so that they are deducted from your bank account.

90. Join Facebook groups whose theme is saving.

Save Money with Insurance:

91. Have good health and car insurance. When emergencies come, you won't have to sacrifice your savings or go into debt.

Save Money with Debts:

92. Seek to refinance your debts and achieve a lower interest . You can also collect all your bank debts in one to save money, reduce time and create payment facilities.

93. Pay off small debts quickly. Then, the money you used in them, use it to pay your major debts.

94. Or for your biggest debt first since you save money on interest.

Save Money with Taxes:

95. Pay your taxes on time to avoid charging interest. When you pay before the deadline you can earn a discount.

Save Money with Technology:

96. Download document editor from google drive instead of paying for Microsoft.

97. Buy technological devices according to your needs, not mega machines that you only use to surf the internet.

Save Money with Home:

98. Don't have 20 toiletries at home. Have a multipurpose one, vinegar or bleach are enough

99. Fabric softener is not necessary. Choose your laundry soap better, it is enough.

100. Maintain your appliances properly.

see also finance and business knowledge

No comments:

Post a Comment